As mask-wearing becomes a political flashpoint—despite coronavirus cases spiking to record levels across the country—new research from Goldman Sachs suggests a national mask mandate would slow the growth rate of new coronavirus infections and prevent a 5% GDP loss caused by additional lockdown measures.

Goldman’s analysts found that wearing face coverings has a significant impact on coronavirus outcomes, and they suggest that a federal mask mandate would “meaningfully” increase mask usage across the country, especially in states like Florida and Texas, where masks are not currently required.

The researchers estimate that a national mandate would increase the portion of people wearing masks by 15 percentage points, and cut the daily growth of new cases by 1.0 percentage point to 0.6%.

Reducing the spread of the virus through mask-wearing, the analysts found, could be a substitute for strict lockdown measures that would otherwise shave 5%—or $1 trillion—off the U.S. GDP.

“If a face mask mandate meaningfully lowers coronavirus infections, it could be valuable not only from a public health perspective but also from an economic perspective because it could substitute for renewed lockdowns that would otherwise hit GDP,” the researchers wrote.

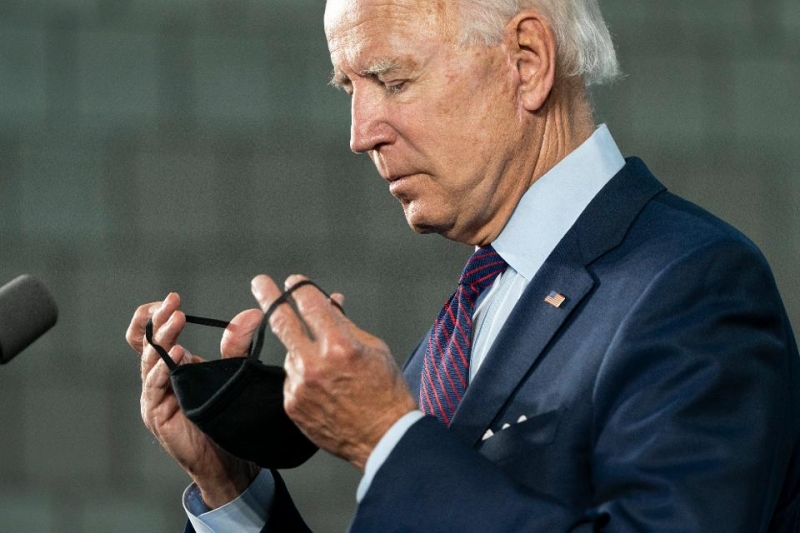

As coronavirus cases rise to record levels, prompting some states to pause or walk back their reopening plans, many lawmakers have called for a national mask mandate. Presumptive presidential nominee Joe Biden said that if he’s elected, he would use federal power to require all Americans to wear masks in public places. House Speaker Nancy Pelosi has also voiced her support for the practice: “Real men wear masks,” she said earlier this month. New York Gov. Andrew Cuomo has also called for an executive order mandating that everyone wear masks in public, suggesting that President Trump—who has downplayed the importance of masks and dismissed suggestions that he wear one—should lead by example.

Forbes Georgia

"Forbes Georgia-ის სარედაქციო ბლოგპოსტების სერია "როგორ გამდიდრდა“ და "საქართველო რეიტინგებში".