In a highly dynamic world, one term is especially fitting: competitiveness. With the rapid development of technology, flexibility has become an essential part of the corporate culture for the companies consistently developing their products and services to make people’s lives easier and more enjoyable. At the same time, consumer tastes are improving and new, more ambitious expectations are being formed, which the companies need to support.

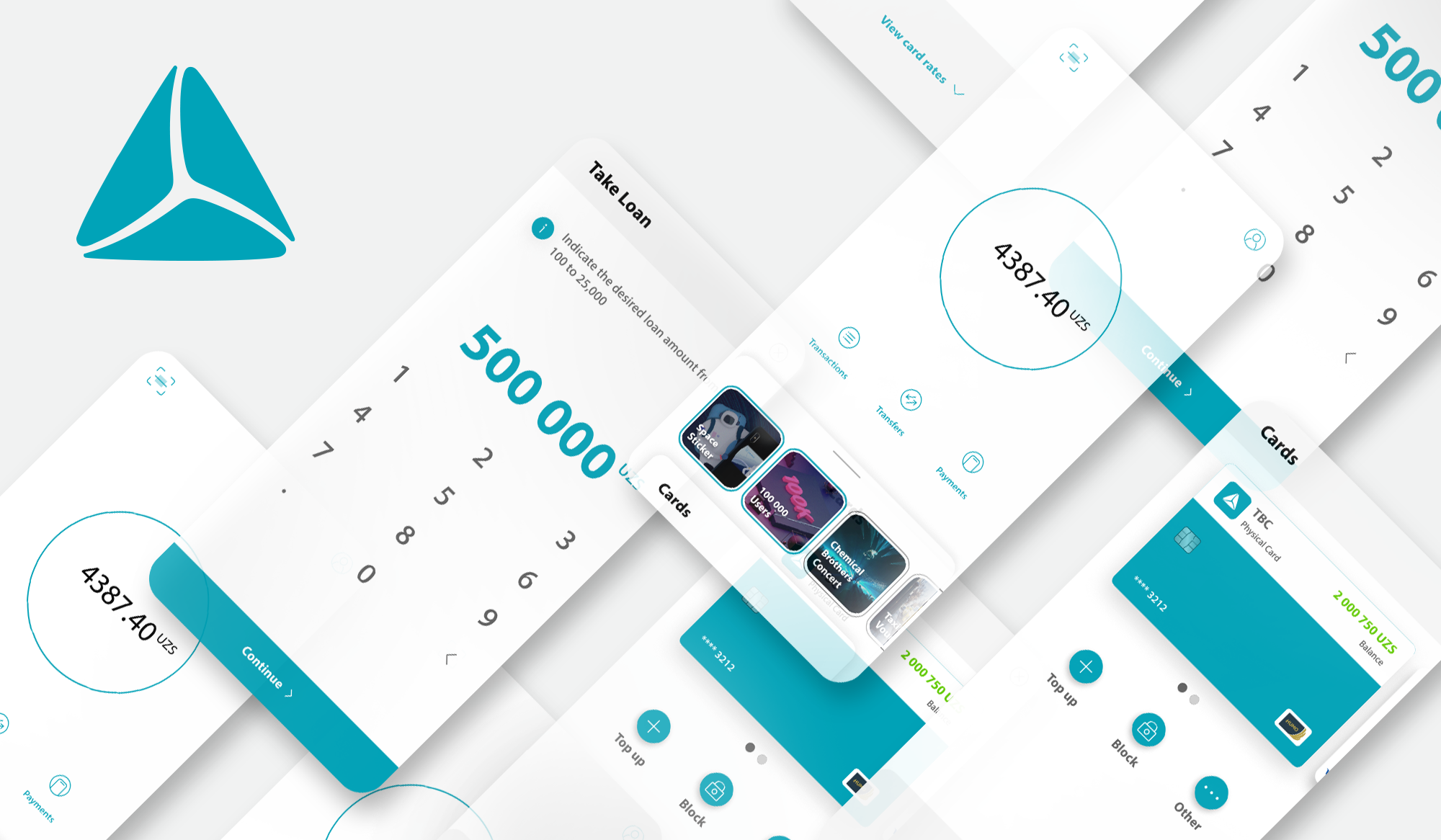

TBC Company is a prominent representative of this international trend. It has created the first fully digital bank both in Georgia and in the region, called Space. Space is a new generation, technologically sophisticated and large-scale digital bank, which is on par with the financial-technology companies firmly established in the international arena. In some respects, it may appear even superior.

In May 2020, TBC Bank obtained a banking license from the Uzbek regulator, under which it launched a fully digital Space-based bank in the framework of the TBC UZ brand within a few months, achieving all-time high results in just one year. On the Uzbek market, as well as in Georgia, in the case of Neobank Space, the company is developing a retail lending direction and offers its customers a completely new, technologically sophisticated and, most importantly, simple banking experience.

One year after its appearance on the Uzbek market, we spoke to Nika Kurdiani, Chairman of the Supervisory Board for Space and TBC UZ, and Deputy CEO of TBC Bank, on the essence of the largest Georgian fintech, Space, its international success and future plans.

One million downloads of the TBC UZ app in Uzbekistan is an important milestone. What is your take on this achievement and could you tell more about the path that TBC has taken over the past year?

This achievement is, in itself, an achievement of Uzbekistan, but in essence, the following is the case: around three years ago, at its base in Georgia, TBC Bank created a neobank-type fintech, Space. This was the first fully digital, mobile-only banking service; to put it simply, Space has everything you need for day-to-day banking.

However, when launching this service, our ambition was not to operate solely on the Georgian market. From the very outset, we expected to launch this tool on the international market. Georgian market was used as a test market; within the company we call it a lab. The first international market we have adopted is Uzbekistan, due to its large population size which is about 35 million people. At the same time, thanks to the reforms, Uzbekistan is an economically fast-growing country.

Thus, we entered the market. We launched the brand TBC UZ, which in Georgia is known as Space whereas abroad it is known as TBC, seeing as we are talking about TBC expansion. However, it should be noted that the platform remains the same and the company is similarly called the international banking platform Space. Interestingly enough, in Uzbekistan we operate on the basis of a banking license, which allows us to service loans, deposits, accounts and cards. The license was obtained in May 2020, and followed by the launching of the app on the market later in October.

When talking about the app, it should be noted that the team developing the technology platform and products, leading digital marketing and sales, managing risk systems, and doing a lot of other things, is located in Georgia. A lot is being done from Georgia. The whole process is centralized and, in fact, the international banking platform Space serves two geographical units from Georgia: Under the name of Space, it serves Georgia, whereas in Uzbekistan it is operated under the brand TBC UZ.

Will it remain this way?

Indeed, it will. This is part of our vision. Let’s take Uber for example: The company’s development team is based in San Francisco and manages Uber’s Ukrainian product from there. Of course, they have a team responsible for localizing the company over in Ukraine, but the company’s commercial brain, i.e. the product strategists, are developing the platform centrally, from one location. This is beneficial as it makes the platform more efficient, effective and much more scalable – it serves numerous locations from a single one. Our concept is to “Develop once, deploy many times”. We prefer to create one single product and implement it in many places, rather than set up a separate bank in each and every country.

Does operating from Georgia come with financial benefits?

Indeed it does. Otherwise, a technology team responsible for product development would be required in every single country, which would differentiate product and marketing approaches between the countries. With such an approach, we would have to duplicate resources and approaches. Instead of five centralized international products, we would have to work on two hundred and thirty-five products. The whole essence lies in supercentralization and superstandardization.

What were the TBC UZ achievements in the last year?

Last year marked the following milestones: based on an Uzbek banking license, we set up TBC Bank Uzbekistan, which has 650 employees. This bank does not have branches as it is fully digital. We provide no offline services, except for the so-called showrooming. These showrooms exist in almost all regions: in total, 65 locations across the country.

Additionally, our app has one million downloads, of which more than 750,000 customers have turned into users; this means that a person has not only downloaded the application, but also started using it. Having indicated their name, they gave us access to their personal data are open for contact to offer our services. This is an incredibly high number, as it is not easy to set up a bank in such a market in one year, attracting one million downloads and 750,000 users.

Let’s review other products as well: we issued up to 200 thousand cards, attracted 100 million GEL deposits and issued 80 million GEL loans. Apart from this, we have 200 thousand active users engaging with our app every month. For one year, these numbers are huge and we hope to keep this trend up.

When talking about Uzbekistan, what kind of market are we talking about? Do people have access to the internet and smartphones?

The market penetration for smartphones is around 50%. In the youth segment, this figure is even higher. In this respect, Uzbekistan is quite a developed country compared to its neighborhood. In addition, digital financial services, especially means of payment, are highly developed in the country. In a way, these services are even more developed in Uzbekistan than in Georgia, as people use applications for P2P transfers and utility payments. Moreover, more than twenty-five million plastic cards have been printed and there are half a million POS terminals.

In the context of payments, Uzbekistan has a fairly developed market, as evidenced by the results of our second company, Payme, which has up to 5 million registrants. This is a very high number: one-seventh of the population is registered with us. Finally, I would say that in the context of the consumption of digital products, the Uzbek market is quite developed.

Let’s take a look at the products. It is well-known that you started in the field of retail lending; I wonder if you switched to offering new products last year?

Our segment has always been retail, but this will be done digitally, through the Space platform. I emphasize this fact because it is important to understand that Space is a multi-geographical fintech platform: from one location, i.e. Georgia, this platform serves several other locations. We are thinking of incorporating some new locations in the future and entering new markets could be a possibility in 2023. We are ambitious: we would like to adopt one location per year.

As for the products, we offer deposit, loan, P2P-transfer, plastic and virtual cards, utility payments and payment installments.

Earlier you mentioned that a corporate direction in Uzbekistan would not be viable. Could you elaborate as to why?

Corporate customer service requires a different business model, which is very difficult to implement in a fully digital format. Additionally, before issuing bulk loans, familiarizing with the country is important. Overseas we are perceived as guests and thus, may not succeed with large corporate clients, as they usually rely on relationship banking. Having a long-term relationship with them, having them know and trust you, making sure that you will support them when needed, makes doing business a lot easier. All this requires a lot of time and non-digital energy, which is beyond our strategic focus, and why we have refused it at the very outset.

What sets Space apart from other international neo-banks, such as Revolut and N26?

What is the competitive advantage of Space? Nothing. Easy as that. Space has nothing that sets it apart from others. It’s a neo-bank just like any other, but not inferior by any means, which is critically important. It’s just that we focus on other locations: had we entered Germany or England, we would have had to compete with other neo-banks.

What is the legal framework on the markets where you would like to launch? As I understand, post-Soviet countries have a tendency to liberalize the banking and financial sectors in general. Is this the case?

We are very familiar with the Georgian market and we know the ongoing processes. As for Uzbekistan, banking regulations are being developed intensively and the digitization component is being actively introduced. For example, last week, insurance companies were allowed to use digital insurance policies. Last month, they allowed for a completely digital method for customer onboarding. Thus, Uzbekistan is quite active at developing modern banking regulations, which is very beneficial for us, as most of the regulations are in favor of digitization.

TBC has long undergone rebranding and has positioned itself as a technology company. TBC Group recently became the full owner of My.ge. Do these steps indicate that TBC is going to become a Super App?

Indeed it does. We have announced that an ecosystem approach is being implemented – these platforms were acquired by TBC Group due to this very reason. Now we are creating an open ecosystem, one of the participants of which will be TBC Bank.

Is it legally permissible for TBC Group, the owner of the largest bank, to be simultaneously involved in different types of business?

This project is implemented by TBC Group and not TBC Bank. The legislation allows for this. The ecosystem shall be open and, on competitive terms, other players should be introduced, including other banks.

What is the relationship of Space with other fintech companies?

Positive. Collaboration is key.

What do the future plans look like for Space? Which markets do you plan to acquire and when?

I can not talk about the specifics, but what I can say is that we would like to start further expansion from 2022 onwards. As a result of this expansion, we will be obtaining a banking license in a number of countries, based on which, we will be launching the digital platform Space under the TBC brand.

Featured Image: Nika Kurdiani / Helloblog